Bond yields in key global economies—the United States, Japan, and Germany

Bond yields in major economies such as the United States, Japan, and Germany have surged to multi-year highs, signaling heightened uncertainty and increased borrowing costs in global fixed income markets. The yield on the U.S. 30-year Treasury recently exceeded 5%, a level not seen since 2007, reflecting strong federal borrowing needs, inflation concerns, and cautious investor sentiment. Similarly, Japan’s 30-year government bond yields have risen above 3%, spurred by political instability and fiscal worries. In Germany, 10- and 30-year yields have climbed to their highest levels in over a decade, influenced by extensive government spending plans and eurozone economic challenges.

Bond yields in key global economies—the United States, Japan, and Germany—have reached multi-year highs in early September 2025, reflecting elevated fiscal uncertainty,

persistently high borrowing needs, and investor concerns about debt sustainability.

Bond Yields:

These rising yields indicate that investors are demanding higher returns to offset risks related to

fiscal deficits, inflation, and geopolitical uncertainties. The increased borrowing costs have ripple effects on governments, businesses, and consumers, potentially

tightening credit conditions and impacting economic growth.

U.S. Treasury Yields:

The yield on the U.S. 30-year Treasury surpassed 5% for the first time since 2007, while the 10-year benchmark approached 4.3%, amplifying

volatility across fixed income markets. This surge is driven by record federal borrowing, aggressive market supply, and a cautious investor base awaiting clarity on fiscal

policy and Federal Reserve decisions on interest rates.

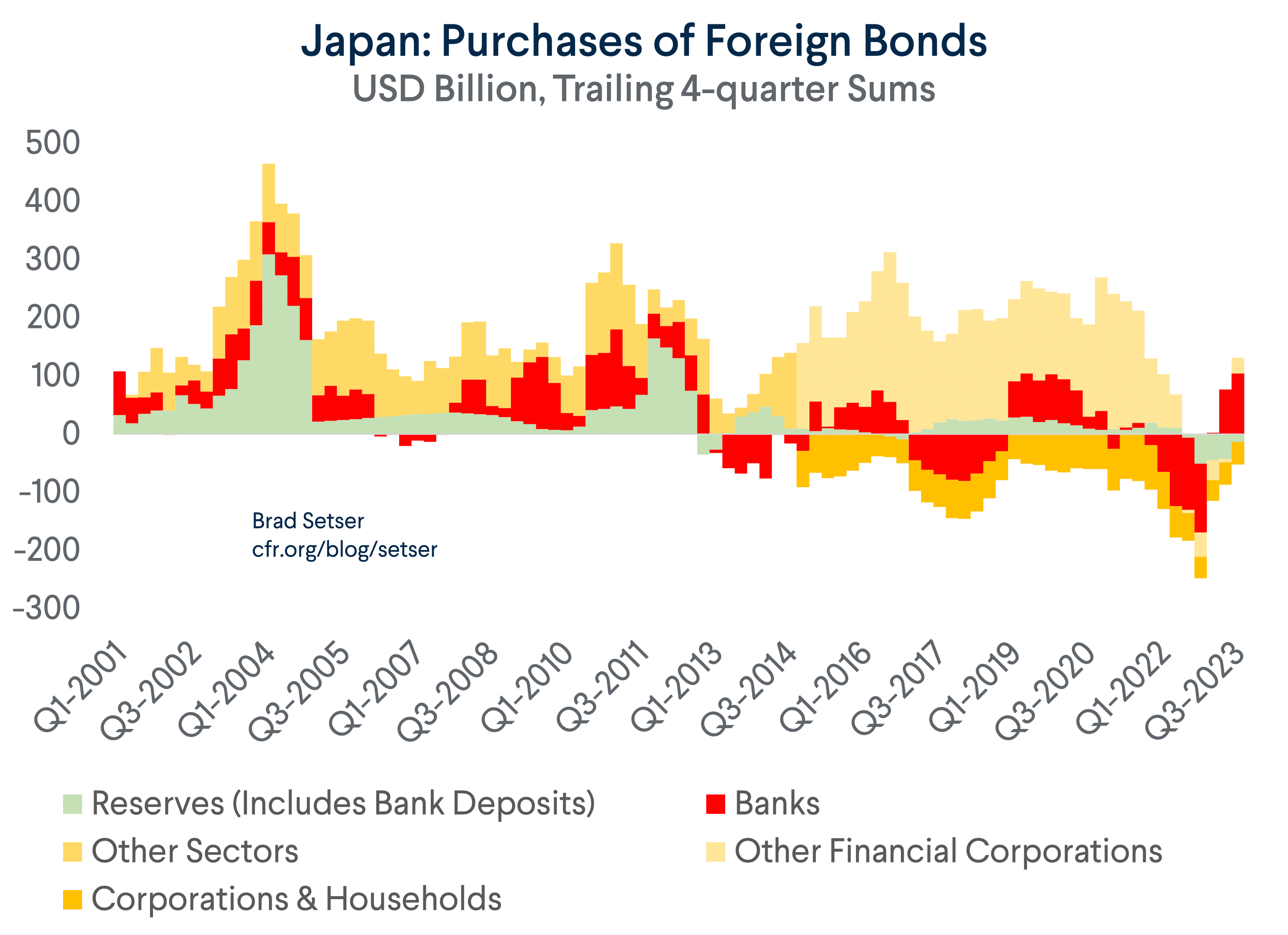

Japan:

Yields on Japan’s 30-year government bonds have climbed above 3%, reacting to political instability and concerns about fiscal sustainability, marking a

notable departure from years of ultra-low rates.

Germany:

The German 10-year yield reached 2.67%, and 30-year yields neared 3%—their highest in 14 years—on the back of heavy government spending plans and

wider eurozone political challenges.

Market Dynamics and Investor Tests Investor demand will be tested with a series of upcoming long-term government bond auctions, as governments seek to refinance significant amounts of debt. High yields indicate that investors are demanding more compensation for perceived risks, including rising fiscal deficits, inflation uncertainty, and potential policy changes. Implications for Financial Markets Surging yields mean increased borrowing costs for governments, businesses, and consumers, often leading to tighter financial conditions and additional market volatility. The spike in yields has contributed to recent swings in equity markets, currency valuations, and risk premiums on corporate bonds. Many investors are closely watching central bank meetings in coming weeks for signals about future rate hikes or policy adjustments that could impact yield curves and market appetite. Outlook With bond yields at multi-year highs, the upcoming auctions and fiscal decisions in major economies are likely to shape global financial conditions and investor sentiment throughout the remainder of 2025.

Bond yields in key global economies—the United States, Japan, and Germany—have reached multi-year highs in early September 2025, reflecting elevated fiscal uncertainty,

persistently high borrowing needs, and investor concerns about debt sustainability.

Bond Yields:

These rising yields indicate that investors are demanding higher returns to offset risks related to

fiscal deficits, inflation, and geopolitical uncertainties. The increased borrowing costs have ripple effects on governments, businesses, and consumers, potentially

tightening credit conditions and impacting economic growth.

U.S. Treasury Yields:

The yield on the U.S. 30-year Treasury surpassed 5% for the first time since 2007, while the 10-year benchmark approached 4.3%, amplifying

volatility across fixed income markets. This surge is driven by record federal borrowing, aggressive market supply, and a cautious investor base awaiting clarity on fiscal

policy and Federal Reserve decisions on interest rates.

Japan:

Yields on Japan’s 30-year government bonds have climbed above 3%, reacting to political instability and concerns about fiscal sustainability, marking a

notable departure from years of ultra-low rates.

Germany:

The German 10-year yield reached 2.67%, and 30-year yields neared 3%—their highest in 14 years—on the back of heavy government spending plans and

wider eurozone political challenges.

Market Dynamics and Investor Tests Investor demand will be tested with a series of upcoming long-term government bond auctions, as governments seek to refinance significant amounts of debt. High yields indicate that investors are demanding more compensation for perceived risks, including rising fiscal deficits, inflation uncertainty, and potential policy changes. Implications for Financial Markets Surging yields mean increased borrowing costs for governments, businesses, and consumers, often leading to tighter financial conditions and additional market volatility. The spike in yields has contributed to recent swings in equity markets, currency valuations, and risk premiums on corporate bonds. Many investors are closely watching central bank meetings in coming weeks for signals about future rate hikes or policy adjustments that could impact yield curves and market appetite. Outlook With bond yields at multi-year highs, the upcoming auctions and fiscal decisions in major economies are likely to shape global financial conditions and investor sentiment throughout the remainder of 2025.